|

| Image: Moneybestpal.com |

What is Debt Ratio

The debt ratio is a financial metric used to assess how much of an organization's assets are financed by debt, or how much leverage the company has. To calculate it, divide the total debt by the total assets, and then express the result as a percentage or decimal.Why Debt Ratio is Important?

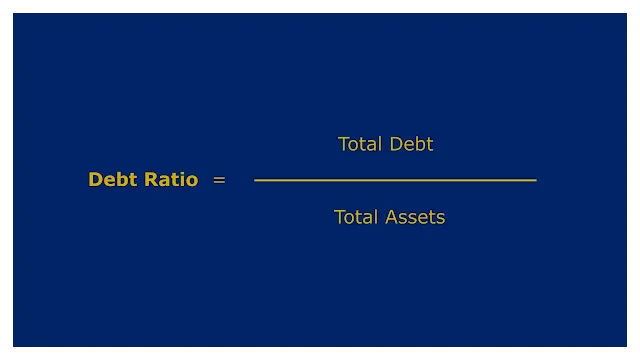

Formula for Debt Ratio

The formula for the debt ratio is:Debt ratio = Total debt / Total assets

For example, if a company has total debt of $50 million and total assets of $100 million, its debt ratio is:

Debt ratio = $50 million / $100 million

Debt ratio = 0.5 or 50%

How to Calculate Debt Ratio

Examples of Debt Ratio

Let's look at some examples of debt ratios for different companies:Company A has total debt of $20 million and total assets of $40 million. Its debt ratio is:

Debt ratio = $20 million / $40 million

Debt ratio = 0.5 or 50%

Company B has total debt of $30 million and total assets of $60 million. Its debt ratio is:

Debt ratio = $30 million / $60 million

Debt ratio = 0.5 or 50%

Company C has total debt of $40 million and total assets of $80 million. Its debt ratio is:

Debt ratio = $40 million / $80 million

Debt ratio = 0.5 or 50%

As you can see, all three companies have the same debt ratio of 50%, which means that they are equally leveraged and have the same proportion of debt to assets.

Limitations of Debt Ratio

Debt ratio is a useful measure of leverage, but it has some limitations that you should be aware of:- The quality or maturity of the debt is not taken into account by the debt ratio. For instance, a business can have a low debt ratio but a large amount of short-term debt that requires quick refinancing. On the other hand, a business could have a high debt ratio along with a long-term loan maturity and low-interest rate.

- The company's cash flow and earning potential are not taken into account by the debt ratio. A business might, for instance, have a high debt ratio in addition to a strong return on assets and operating cash flow, which would enable it to pay down its principal and interest debt with ease. On the other hand, a business with a low debt ratio could also have a low operating cash flow and return on assets, making it difficult for it to make ends meet with principal and interest payments.

- The debt ratio does not take the company's industry or market conditions into account. For instance, certain industries need more debt to finance their operations because they demand more capital than others. Comparably, certain markets are more stable than others and permit businesses to incur higher debt levels without running the danger of default.

FAQ

There is no definitive answer to what constitutes a good or bad debt ratio, as it depends on various factors such as the industry, market conditions, growth prospects, profitability, etc. However, some general guidelines are:

- A debt ratio of less than 0.4 or 40% is considered low and indicates that a company has more equity than debt.

- A debt ratio of between 0.4 and 0.6 or 40% to 60% is considered moderate and indicates that a company has a balanced mix of equity and debt.

- A debt ratio of more than 0.6 or 60% is considered high and indicates that a company has more debt than equity.

A company can improve its debt ratio by either reducing its total debt or increasing its total assets. Some ways to do this are:

- Using stock or cash to settle existing debt.

- Rescheduling current debt to have longer maturities or cheaper interest rates.

- To raise the equity held by shareholders, fresh equity may be issued or profits may be retained.

- Putting money into successful endeavors or assets that yield a profit.

- The sale or disposal of cash- and resource-consuming non-core or underperforming assets.

Due to its impact on a company's cost of capital—the lowest rate of return on investment required to meet investor demands—debt ratio has an effect on a company's valuation. More debt entails more risk and interest costs, which often translates to a higher cost of capital for a given debt ratio.

Since reduced debt entails lower risk and interest costs, a lower debt ratio typically corresponds to a lower cost of capital. As a result of a lower current value of future cash flows, a greater cost of capital decreases a company's worth. As a company's future cash flows have a higher present value due to a lower cost of capital, its valuation rises.