|

| Image: Moneybestpal.com |

What is Debt-to-Equity Ratio

The debt-to-equity ratio (D/E) is a financial metric that evaluates a company's total debt in relation to the equity held by its shareholders. It gauges the extent to which a business depends on debt to fund its operations and expansion.Why Debt-to-Equity Ratio is important?

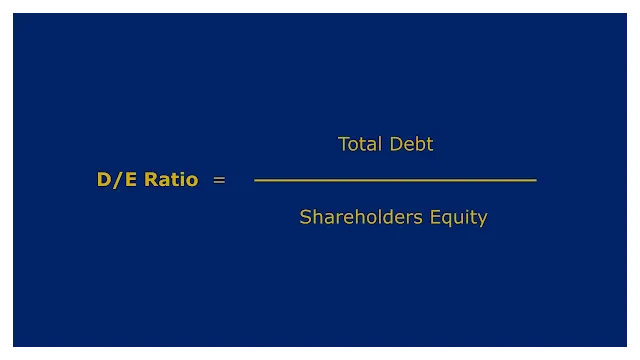

Formula of Debt-to-Equity Ratio

The formula for the debt-to-equity ratio is:D/E = Total Debt / Shareholders' Equity

Total debt includes both short-term and long-term liabilities, such as bank loans, bonds, leases, accounts payable, and other obligations. Shareholders' equity includes common stock, preferred stock, retained earnings, and other components of equity.

How to calculate Debt-to-Equity Ratio

Assets = Liabilities + Shareholders' Equity

$100 million = $60 million + $40 million

The total debt is $60 million and the shareholders' equity is $40 million. Therefore, the debt-to-equity ratio is:

D/E = $60 million / $40 million

D/E = 1.5

This means that for every dollar of equity, the company has $1.5 of debt.

Examples of Debt-to-Equity Ratio

Here are some examples of D/E ratios for some well-known companies as of December 31, 2020:

- Apple: 1.57

- Microsoft: 0.61

- Amazon: 0.83

- Tesla: 2.24

- Coca-Cola: 2.63

- McDonald's: -8.78

Limitations of Debt-to-Equity Ratio

The debt-to-equity ratio is a useful indicator of a company's leverage and risk, but it also has some limitations, such as:- Both the quality and maturity of debt are not taken into consideration. As an illustration, even though both companies have the same D/E ratio, a company with long-term fixed-rate debt may be less dangerous than one with short-term variable-rate debt.

- The profitability and expansion prospects of a business are not taken into consideration. If a company with a high debt-to-earnings ratio is able to allocate its borrowed capital to productive ventures, it could potentially yield greater returns on equity than a lesser ratio company.

- The market values of debt and equity are not taken into consideration. For instance, if a company's share price has drastically dropped or its debt has increased, a low D/E ratio based on book values may have a high D/E ratio based on market values.

FAQ

What makes a good or terrible D/E ratio is a subject of debate because it depends on a number of variables, including the industry, the state of the economy, the business strategy, and the preferences of investors.

Generally speaking, a balanced capital structure that permits a business to gain from both debt and equity financing without incurring undue risk or forfeiting financial flexibility may be indicated by a moderate D/E ratio.

Reducing debt or raising equity are two ways that a business can raise its debt-to-equity ratio. For instance, a business can use its cash flow to pay off debt, refinance it on more advantageous terms, sell certain assets to pay off debt, raise capital by issuing new shares, keep more of its earnings, or improve its profitability and valuation.