|

| Image: Moneybestpal.com |

Accretion is a phrase that can signify several things depending on the situation, but it typically refers to anything growing gradually and incrementally. Bonds, mergers & acquisitions, and earnings are all examples of accretion in finance.

Accretion in Bond Market

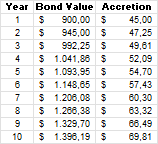

When a bond is issued, it has a face value (also known as the par value), which is equal to the sum that the issuer commits to reimburse the bondholder for when it matures. Yet, depending on supply and demand, interest rates, credit ratings, and other variables, bonds may be traded in the secondary market at prices that are different from their face values.When a bond's market price is less than its face value, it is said to have been bought at a discount. For instance, a bond with a $1,000 face value could be bought for $900. This implies that when the bond matures, the bondholder will get more money than they invested. The accretion discount is the amount that separates the face value from the purchasing price.

Throughout the course of the bond's life, the accretion discount is realized by the bondholder as income. The straight-line approach and the constant yield method are the two ways to account for the accretion discount.

The accretion discount is distributed evenly over each period until maturity using the straight-line technique. The accretion discount of $100 will be divided by the bond's duration of 10 years, yielding an annual accretion of $10, for instance, if the bond's face value of $1,000 is purchased for $900 and the period is 10 years.

|

| Image: Moneybestpal.com |

As you can see, the constant yield method reflects the compound interest effect of the bond.

Accretion in Mergers and Acquisitions

Accretion is the term used to describe the rise in the merged entity's earnings per share (EPS) following a merger or acquisition. To determine earnings per share (EPS), divide net income accessible to common shareholders by the total number of outstanding common shares.

When a merger boosts the acquirer's EPS after all associated expenses and synergies have been taken into account, it is said to be accretive. If, for instance, Company A had an EPS of $2 before purchasing Company B and an EPS of $2.50 after acquiring Company B, the transaction would be 25% accretive.

A transaction is considered dilutive when it decreases the EPS of the acquirer after accounting for all costs and synergies associated with the deal. For instance, if company A had an EPS of $2 prior to purchasing firm B, but now has an EPS of $1.80, the acquisition equals 10% dilution.

The accretion or dilution of a transaction depends on several factors, such as:

- The relative size and valuation of the acquirer and target

- The method and price of payment (cash, stock, or debt)

- The expected cost savings and revenue enhancements from synergies

- The tax implications and accounting treatment of the deal

In general, an acquirer will favor acquiring a target whose price-to-earnings (P/E) ratio is lower than its own because doing so will raise the merged entity's EPS. In contrast, an acquirer will steer clear of acquiring a target with a greater P/E ratio than its own because doing so will reduce the combined entity's EPS.

Accretion in Earnings

The term "accretion in earnings" describes the gradual organic growth of a company's net income, independent of outside influences like acquisitions or sales. Gaining more money can be done via raising sales, cutting expenses, boosting margins, growing market share, or introducing new goods or services.

Earnings growth is a sign that a company is doing well financially and adding value. It demonstrates that the business can make more money from its current activities and assets and that it enjoys a stable competitive advantage in its sector.

Accretion in earnings can be measured by comparing the growth rate of a company's EPS over time, or by using metrics such as return on equity (ROE), return on invested capital (ROIC), or economic value added (EVA).

Non-operating variables like adjustments to accounting principles, tax rates, share buybacks, or unusual events can also have an impact on the accretion in earnings. Consequently, while examining the accretion in earnings of a corporation, it is crucial to account for these aspects.