|

| Image: Moneybestpal.com |

Asset allocation is the process of distributing the various asset classes in your investing portfolio, such as stocks, bonds, cash, and alternatives. Achieving a risk-reward balance based on your investing objectives, risk tolerance, and time horizon is the aim of asset allocation.

The importance of asset allocation stems from the fact that various asset classes have varying degrees of risk and return, as well as a propensity to act in various ways depending on the market environment. As an illustration, equities often have bigger potential returns but also more volatility than bonds. In contrast to stocks, bonds often offer more income and stability but lower returns. The benefits of diversity and lowering portfolio volatility can be derived from cash and alternatives.

You can develop a mix that fits your risk-reward profile and aids in the accomplishment of your financial objectives by distributing your portfolio among several asset classes. Your portfolio can be adjusted over time as your objectives and situation change with asset allocation.

How to choose an asset allocation strategy

There is no one-size-fits-all asset allocation strategy that works for everyone. Your optimal asset allocation depends on several factors, such as:- Your investment objective: What are you investing for? Retirement, education, a home purchase, or something else?

- Your risk tolerance: How much risk are you willing to take with your investments? How do you react to market fluctuations?

- Your time horizon: How long do you plan to invest? When do you need to access your money?

- Your personal preferences: What are your values, beliefs, and preferences regarding investing?

You can select an asset allocation strategy that fits your risk-reward profile based on these variables. For instance, if you have a high-risk tolerance and are investing for a long-term objective like retirement, you may select a more aggressive asset allocation that prioritizes equities over bonds. On the other side, if you have a low-risk tolerance and are investing for a short-term purpose, like a vacation, you may select a more cautious asset allocation that favors bonds over equities.

An asset allocation plan can be put into practice in a variety of ways. The percentage of equities in your portfolio can be calculated using a straightforward rule of thumb, such as subtracting your age from 100. Another option is to employ a more complex strategy, such as an optimization model that maximizes predicted return for a given level of risk or minimizes risk for a given level of return.

As an alternative, you can utilize an asset allocation tool that handles the calculations for you. For instance, BlackRock provides Core and Sustainable asset allocation options. Each solution comprises of a variety of funds with exposure to US equities, international stocks, and bonds that rebalance back to predetermined weights in accordance with four different risk profiles: conservative, moderate, growth, and aggressive.

The iShares Core ETFs used in the Core solution aim to follow reputable, well-known indices. The sustainable approach makes use of iShares ESG Aware ETFs, which aim to balance seeking comparable risk and return to the relevant wide market while leaning toward businesses with favorable environmental, social, and governance (ESG) ratings.

The benefits of using an asset allocation solution include:

- Simplicity: You can build a diversified portfolio with one fund that matches your risk profile.

- Efficiency: You can harness the experience of BlackRock and the efficiency of iShares ETFs to get a broad mix of bonds and global stocks.

- Flexibility: You can use the funds to establish a long-term, balanced portfolio or as building blocks for a more customized portfolio.

- Sustainability: You can align your investments with your values and preferences regarding ESG issues.

The performance of asset allocation strategies

The market conditions, asset class returns, portfolio weights, frequency of rebalancing, and fees and charges are just a few of the variables that affect how well asset allocation schemes perform.

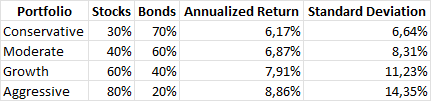

We may use data from BlackRock's website to show the historical performance of various asset allocation techniques. The table below displays four fictitious portfolios' annualized returns and standard deviations from January 2008 through June 2021 using BlackRock's Core Allocation Funds.

|

| Image: Moneybestpal.com |

As anticipated, the more aggressive strategies outperformed the more conservative portfolios in terms of returns while also experiencing higher volatility. Also, the table illustrates the trade-off between risk and return: there is an additional unit of risk for every greater unit of return.

The most important lesson is that asset allocation is a decision that you make for yourself based on your own objectives, risk tolerance, time horizon, and preferences. There is no perfect asset mix that works for everyone or all circumstances. To meet your requirements and expectations, you must strike a balance between risk and return.

Allocating assets is a dynamic process. To reflect changes in your circumstances and the market climate, you must frequently review and modify your portfolio. The expenses and advantages of rebalancing your portfolio to maintain your target weights must also be taken into account.

One of the most crucial decisions an investor can make is asset allocation. Your long-term investment results may be significantly impacted by it. You can build a portfolio that aids in your financial success by using a methodical and disciplined approach.