|

| Image: Freepik / rawpixel.com |

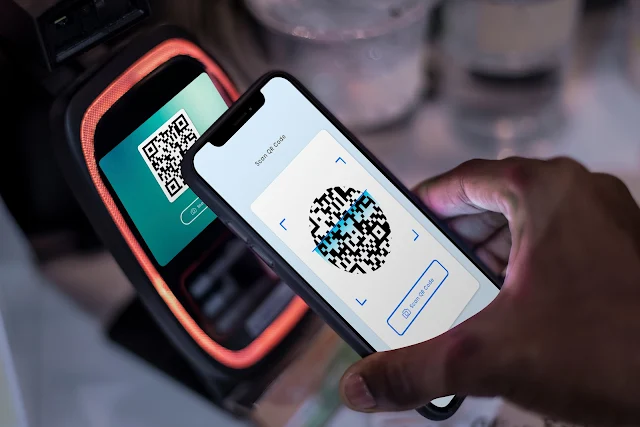

Fintech, short for financial technology, is a rapidly evolving field that encompasses a wide range of technological innovations and advancements aimed at improving and streamlining financial services. These innovations range from mobile banking and online lending to digital payments and blockchain technology, potentially disrupting and transforming traditional banking and financial services.

The impact of fintech on the banking industry is multifaceted and far-reaching. One of the most notable effects is increased efficiency and cost savings through the automation of processes and the utilization of artificial intelligence and machine learning. This can lead to faster and more accurate decision-making and reduce human error. Additionally, fintech can also lead to an improved customer experience through personalization and customization of services, as well as 24/7 access to financial services.

Fintech also presents new revenue streams for the banking industry through the development of new products and services and expansion into new markets. For example, the use of blockchain technology in banking can enable faster and more secure financial transactions, while also providing new investment opportunities.

Fintech adoption in the financial sector is not without difficulties, though. Keeping up with evolving legislation and guaranteeing data security and privacy may be a considerable burden for traditional banks, which is one of the key challenges. Furthermore, the threat of disintermediation from non-traditional competitors like fintech companies can exist for conventional banks.

Managing risk and uncertainty is also a difficulty for the banking sector because it requires constant adaptation to new technological advancements, identification, and mitigation of new threats.

I. Opportunities in Fintech for Banking

A. Increased efficiency and cost savings

1. Automation of processes

Automation of processes refers to the use of technology to automate tasks that were traditionally performed by humans. In the context of the banking industry, automation of processes can refer to a wide range of activities such as account opening, loan processing, compliance and risk management, and even customer service. By automating these tasks, banks can improve efficiency, reduce errors, and lower costs.One example of automation in the banking industry is the use of artificial intelligence and machine learning to automate the loan underwriting process. By using data and analytics, AI and machine learning algorithms can quickly and accurately assess a borrower's creditworthiness and make lending decisions. This not only speeds up the loan approval process but also makes it more consistent and objective, as decisions are based on data rather than human judgment.

Another example of automation in banking is the use of robotic process automation (RPA) to automate repetitive and time-consuming tasks such as data entry and account reconciliation. RPA software can be programmed to mimic human actions, such as logging into systems and entering data, which can save banks time and money.

However, automation of processes in the banking industry is not without its challenges. One of the main challenges is the need for significant investment in technology and infrastructure. Banks must also ensure that the automation of processes does not lead to job loss and must have the plan to retrain and upskill employees for new roles. Additionally, it is important to consider the potential ethical and societal implications of automation, such as the potential for bias in decision-making and the displacement of human workers.

2. Use of artificial intelligence and machine learning

Artificial intelligence (AI) and machine learning (ML) are forms of advanced technology that have the ability to analyze large amounts of data and make predictions or decisions without human intervention. These technologies have the potential to revolutionize various industries, including the banking industry.In the banking industry, AI and ML can be used for a wide range of tasks, such as fraud detection, customer service, and credit risk analysis. For example, AI-powered fraud detection systems can analyze large amounts of data to identify patterns and anomalies that indicate fraud, providing a more efficient and accurate way of detecting fraudulent activities. Similarly, banks can use AI-powered chatbots to provide 24/7 customer service, which can help improve customer satisfaction. In addition, ML algorithms can be used to analyze large amounts of data to make a more accurate credit risk assessment, which can improve lending decisions and reduce the risk of default.

Additionally, by examining consumer information and behavior to provide specialized offers and suggestions, AI and ML can be used to enhance the personalization of financial products and services. In addition to generating new revenue streams, this can assist banks to boost customer happiness and loyalty.

The banking business still faces several difficulties when implementing AI and ML. To train and evaluate these systems, they must have access to high-quality data, but doing so can be challenging. Furthermore, there is a chance of bias in decision-making if the data utilized to train the system is skewed, which can have serious repercussions. A significant obstacle is ensuring that AI and ML systems are visible and understandable, which is essential for regulatory compliance and gaining the trust of customers.

B. Improved customer experience

1. Personalization and customization

Personalization and customization refer to the tailoring of products, services, or experiences to the individual needs and preferences of customers. In the context of the banking industry, personalization and customization can refer to the tailoring of financial products and services to the individual needs and preferences of customers.One example of personalization in banking is the use of data and analytics to create tailored financial products and services. Banks can use customer data, such as transactional data, credit history, and demographic data, to create personalized offers and recommendations. For example, a bank can use data on a customer's spending habits to recommend a credit card with rewards that align with the customer's spending patterns. This can help banks increase customer loyalty and satisfaction, and can also lead to new revenue streams.

Another example of personalization in banking is the use of chatbots and virtual assistants to provide 24/7 customer service. These AI-powered systems can analyze customer data and behavior to provide personalized responses, which can help improve customer satisfaction.

Customization in banking is similar to personalization. It refers to the ability of customers to tailor financial products and services to their individual needs. Banks can offer customers the ability to customize their credit cards, loans, and other financial products to suit their needs. For example, customers can choose the interest rate, the repayment period, or the amount of credit limit they want to have.

Customization and personalization in banking, however, provide their own set of difficulties. One of the biggest obstacles is the requirement for high-quality data, which can be challenging to collect and clean, to personalize and create goods and services. In addition, if client data is not handled appropriately, there is a possibility of privacy and security problems. Additionally, some clients can choose a one-size-fits-all strategy and not want their goods and services customized.

2. 24/7 access to services

24/7 access to services refers to the availability of products or services at any time, day or night, seven days a week. In the context of the banking industry, 24/7 access to services can refer to the ability of customers to access their financial information and transact using digital channels such as mobile banking, internet banking, and ATMs.One of the main advantages of 24/7 access to services is increased convenience for customers. With 24/7 access, customers can manage their finances, check their account balances, pay bills, transfer money, and more at their own time and pace, rather than being constrained by traditional banking hours. This can lead to increased customer satisfaction and loyalty.

Another advantage of 24/7 access to services is the ability of banks to offer a wider range of services to customers. For example, with 24/7 access to digital channels, banks can offer a broader range of financial products and services such as loans, credit cards, and insurance. This can help banks increase their revenue streams and expand their customer base.

A 24/7 service is not without difficulties, though. Keeping digital communications secure and reliable is one of the biggest problems. Customers must have faith in the reliability of digital channels, and banks must make sure that client data and transactional information are secure. Banks must also make sure that their systems can manage large quantities of transactions and are always accessible.

C. New revenue streams

1. Development of new products and services

The development of new products and services refers to the process of creating and introducing new offerings to the market. In the context of the banking industry, the development of new products and services can refer to the creation and introduction of new financial products and services to meet the changing needs and preferences of customers.One example of the development of new products and services in banking is the introduction of mobile banking. Mobile banking allows customers to access their financial information and transact using their mobile devices, such as smartphones and tablets. This has led to an increase in convenience for customers, as they can now manage their finances from anywhere, at any time.

Another example of the development of new products and services in banking is the emergence of digital-only banks. Digital-only banks, also known as neobanks, are banks that operate exclusively online and through mobile apps, and do not have physical branches. These banks can offer a wider range of services such as savings accounts, checking accounts, and credit cards.

Moreover, the development of new products and services in banking can also include the use of blockchain technology, which can enable faster and more secure financial transactions and can also provide new investment opportunities.

It is not without difficulties for the banking industry to produce new goods and services. The necessity for substantial investment in research and development, which can be expensive, is one of the key obstacles. Failure is also a possibility if novel goods and services don't satisfy consumer preferences or demands. For banks to be able to respond to the shifting market conditions, they also need to keep knowledgeable about and current with changing consumer wants and preferences.

2. Expansion into new markets

Expansion into new markets refers to the process of entering new geographic markets or segments to increase revenue and growth. In the context of the banking industry, expansion into new markets can refer to the process of entering new geographic regions or customer segments to increase revenue and growth.One example of expansion into new markets in the banking industry is the entry into emerging markets. Emerging markets are countries with developing economies that offer significant growth potential for businesses. Banks can enter these markets by opening new branches or by partnering with local banks. This can help banks tap into new revenue streams and increase their customer base.

Another example of expansion into new markets in banking is the entry into new customer segments, such as small and medium-sized enterprises (SMEs) or low-income individuals. Banks can enter these segments by offering tailored products and services to meet their specific needs, such as micro-loans or savings accounts with low minimum balances.

New market expansion is not without difficulties. One of the main challenges is the need to navigate unfamiliar legal and regulatory environments, which can be complex and time-consuming. Additionally, there is the risk of cultural and language barriers, which can make it difficult for banks to communicate and connect with new customers. Moreover, Banks need to have a deep understanding of the local market and customer needs to provide relevant and appropriate products and services, which can be challenging.

D. Case studies and examples of fintech-banking collaborations

Case studies and examples of fintech-banking collaborations refer to real-world examples of partnerships or collaborations between financial technology (fintech) companies and traditional banks. These partnerships aim to leverage the strengths of both parties to provide innovative and improved financial services to customers.One example of a fintech-banking collaboration is the partnership between JPMorgan Chase and OnDeck, a leading online lender for small businesses. The partnership allows JPMorgan Chase customers to access OnDeck's platform for small business loans, providing customers with faster and more convenient access to credit.

Another example is the collaboration between BBVA, a Spanish multinational bank, and the start-up company Simple. Simple provided BBVA with a white-label version of its mobile banking app, which allows BBVA customers to perform financial transactions, check account balances, and set budgets using their mobile devices. This partnership allowed BBVA to offer a more convenient and user-friendly banking experience to its customers.

Furthermore, many banks are working with fintech companies to use Open Banking to access customers' financial data and to provide personalized and relevant financial services to them. For example, Monzo, a digital bank, is working with Plaid, a fintech company, to provide Monzo's customers with a more comprehensive view of their financial position, which would allow Monzo to offer more relevant financial products and services.

II. Challenges in Fintech for Banking

A. Regulatory and compliance issues

1. Keeping up with changing regulations

Keeping up with changing regulations refers to the process of staying informed and compliant with the laws and regulations that govern the banking industry. The banking industry is heavily regulated, and changes in regulations can have a significant impact on banks' operations, compliance, and risk management.One example of a change in regulations that has had a significant impact on the banking industry is the introduction of the General Data Protection Regulation (GDPR) in the European Union. This regulation, which came into effect in 2018, strengthens the rights of EU citizens over their data and imposes strict rules on how organizations can collect, use, and store personal data. Banks have had to invest in new systems and processes to ensure compliance with the GDPR, which has been costly and time-consuming.

Another example is the introduction of the Basel III regulations, which aimed to strengthen the banking system by increasing the amount of capital and liquidity that banks have to hold. This has had a significant impact on banks' operations, as they have had to raise capital and hold more liquid assets, which has been costly and has reduced the amount of capital available for lending.

To promote innovation and competition, many nations are also enacting open banking legislation that mandates banks to make consumers' financial data accessible to authorized third parties. These rules, which necessitate that banks have trustworthy and secure systems and procedures in place, must be followed by banks.

Nevertheless, keeping up with continually changing regulations could be challenging. It can be time-consuming and expensive to keep up with new and pending regulations, which is one of the key challenges. The difficulty of ensuring compliance with the new legislation is another one, and it can be difficult and expensive. To comply with new requirements, banks must also make sure that their systems and processes are updated and modified, which can be expensive and time-consuming.

Additionally, because the banking business is international and each country has a unique regulatory framework, it may be challenging for banks to stay on top of changing legislation in many jurisdictions. The laws in the area must be thoroughly understood by banks for them to abide by them.

In addition, there is a chance of consequences for non-compliance, such as fines, legal action, and reputational harm. To avoid fines, banks must be able to show that they are following rules and must have strong compliance programs.

2. Ensuring data security and privacy

Ensuring data security and privacy refers to the process of protecting sensitive data from unauthorized access, use, disclosure, disruption, modification, or destruction. In the context of the banking industry, data security and privacy are of paramount importance, as banks handle the sensitive personal and financial information of customers.One example of data security measures in the banking industry is the use of encryption. Encryption is the process of converting plain text into a coded format, which makes it unreadable to unauthorized parties. Banks use encryption to protect sensitive information such as account numbers, passwords, and personal identification numbers (PINs) from being intercepted and read by unauthorized parties.

Another example of data security measures in banking is the use of firewalls. Firewalls are software or hardware devices that act as a barrier between a bank's internal network and the Internet, which can help prevent unauthorized access to the bank's systems and data.

Many banks now employ multi-factor authentication techniques, which offer an extra degree of security by asking customers to present numerous forms of identity before accessing their accounts. A password plus a fingerprint, or a password and a text message-delivered one-time code, can be used in conjunction with this.

The General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), which provide users more control over their personal data and how it is used, are two more rules that are addressed by data privacy safeguards in banking. Customers' data rights must be explained to them by banks, who must also get their permission before collecting any data and give them the option of accessing and erasing it.

Ensuring data security and privacy, however, is not without difficulties. Keeping up with the constantly changing threat landscape is one of the biggest problems. The systems and procedures used by banks must be current and capable of defending against new and emerging risks. Human mistake also poses a risk, as evidenced by workers accidentally revealing sensitive data or falling for phishing attacks.

B. Competition from non-traditional players

1. Threat of disintermediation

The threat of disintermediation refers to the potential for new technologies or business models to disrupt traditional intermediaries, such as banks, by providing customers with direct access to financial services. In the context of the banking industry, disintermediation is a concern as new financial technology (fintech) companies have emerged that use technology to provide financial services directly to customers, bypassing traditional banks.One example of disintermediation in the banking industry is the emergence of online lending platforms, such as Lending Club and Prosper. These platforms allow customers to borrow money directly from investors, bypassing traditional banks. These platforms have grown rapidly in recent years, and have the potential to disrupt traditional banks' lending businesses.

Another example of disintermediation in banking is the emergence of digital-only banks, also known as neobanks, which operate exclusively online and through mobile apps, and do not have physical branches. These banks can offer a wider range of services such as savings accounts, checking accounts, and credit cards, which can be more convenient for customers and can also attract customers away from traditional banks.

Disintermediation is a threat, but it is not without difficulties. Competition from fintech businesses, which can be more nimble and able to react fast to shifting customer wants and preferences, is one of the key issues. Furthermore, traditional banks run the danger of losing customers and revenue to fintech firms, which can be challenging for them to make up for.

In conclusion, the threat of disintermediation is a concern for the banking industry as new technologies and business models have emerged that can bypass traditional intermediaries and provide customers with direct access to financial services. Banks need to adapt to this changing landscape by leveraging technology and providing more convenient and user-friendly services to stay competitive and meet the changing needs and preferences of customers. Additionally, they need to be aware of the competition from fintech companies and the risk of losing market share and revenue.

To mitigate the threat of disintermediation, traditional banks can consider partnering with or investing in fintech companies, to take advantage of their technological expertise and innovative business models. Additionally, traditional banks can also focus on improving the customer experience, by providing more convenient and user-friendly services, and by leveraging technology to improve efficiency and reduce costs.

Traditional banks can also concentrate on their advantages over fintech firms, such as their well-established brand, reputation, and network of ATMs and branches. These factors provide them an edge over fintech firms.

2. New entrants with different business models

New entrants with different business models refer to the emergence of new companies and organizations that enter the banking industry with new and innovative business models that differ from traditional banking models. These new entrants are often technology-driven and use advanced technologies such as artificial intelligence, blockchain, and digital platforms to provide financial services to customers.One example of new entrants with different business models is digital-only banks or neobanks, which operate exclusively online and through mobile apps. These banks have no physical branches and rely on technology to provide financial services to customers. They can offer a wider range of services such as savings accounts, checking accounts, and credit cards, and can also provide customers with a more convenient and user-friendly banking experience.

Another example is the emergence of peer-to-peer lending platforms such as Lending Club and Prosper, which allow individuals to lend money to other individuals directly, bypassing traditional banks. These platforms have grown rapidly in recent years, and have the potential to disrupt traditional banks' lending businesses.

Fintech firms that provide specialized financial services like Robo-advisory, digital payments, insurance, and wealth management are another group of new competitors with distinct business models that are starting to appear. These businesses employ technology to provide more individualized and practical financial services, which can entice customers away from conventional banks.

New competitors with various business methods, however, can potentially be a danger to established banks. Competition from new entrants, which can be more nimble and able to react fast to shifting client wants and preferences, is one of the key challenges. In addition, traditional banks run the danger of losing market share and revenue to new competitors, which can be challenging for them to recover from.

C. Managing risk and uncertainty

1. Identifying and mitigating new types of risks

Identifying and mitigating new types of risks refers to the process of identifying and managing emerging risks that are not fully understood or have not been encountered before. In the context of the banking industry, new types of risks can arise from changes in technology, economic conditions, and regulations. These risks can have a significant impact on banks' operations, compliance, and risk management.One example of new types of risks in the banking industry is the rise of cyber risks. Banks are increasingly dependent on technology and digital platforms to provide financial services to customers, which can make them vulnerable to cyber-attacks such as hacking, data breaches, and phishing scams. Banks need to have robust cyber-security measures in place to protect against these risks, such as encryption, firewalls, and multi-factor authentication.

Another example of new types of risks in banking is the rise of operational risks. Banks are facing increased pressure to reduce costs, which can lead to downsizing and outsourcing of non-core activities. This can lead to increased operational risks, such as a lack of control over third-party service providers, and a lack of oversight of outsourced activities. Banks need to have effective operational risk management processes in place to identify and mitigate these risks.

Changes in legislation, such as the implementation of open banking regulations, can also lead to the emergence of new categories of hazards in the banking industry. Banks must abide by these standards, which call for businesses to have trustworthy systems and procedures in place. Failing to do so can result in penalties including fines and legal action.

Nevertheless, there are difficulties involved in recognizing and reducing new kinds of dangers. Maintaining awareness of new and emerging hazards can be time-consuming and expensive, making it one of the biggest difficulties. In addition, ensuring compliance with new legislation presents a task that can be difficult and expensive.

2. Adapting to rapidly changing technologies

Adapting to rapidly changing technologies refers to the process of keeping up with and implementing new technologies to improve efficiency and stay competitive. In the context of the banking industry, rapidly changing technologies can include advancements in areas such as artificial intelligence, blockchain, and digital platforms.One example of adapting to rapidly changing technologies in the banking industry is the use of artificial intelligence and machine learning. Banks can use these technologies to improve the customer experience, such as by providing more personalized and convenient services, and to improve the efficiency of their operations, such as by automating routine tasks.

Another example of adapting to rapidly changing technologies in banking is the use of blockchain. Blockchain is a distributed ledger technology that can be used to record and verify transactions securely and transparently. Banks can use blockchain to improve the efficiency of their operations and to reduce costs, as well as to create new products and services, such as digital currencies.

The use of digital platforms and APIs, which can enable new banking services like open banking and help banks access new consumer groups and expand into new markets, is another way to adapt to quickly changing technologies.

But adjusting to constantly evolving technologies is not without its difficulties. Keeping up with new and developing technology can be time-consuming and expensive, which is one of the key challenges. It can be difficult and time-consuming to ensure that new technologies are integrated with old systems and procedures. This is another challenge.

D. Case studies and examples of challenges faced by the banking industry in adopting fintech

Case studies and examples of challenges faced by the banking industry in adopting fintech refer to the examination of real-world examples of the difficulties that banks have encountered when trying to implement new financial technologies in their operations. These challenges can include a range of factors such as technical, regulatory, and cultural issues.One example of challenges faced by banks in adopting fintech is the issue of data security and privacy. Banks handle sensitive customer data and are subject to strict regulations regarding data protection. Fintech companies may not have the same level of security and compliance measures in place, which can create difficulties for banks when working with them.

Another example of challenges faced by banks in adopting fintech is the issue of cultural resistance. Banks have a long history of traditional business practices, which can make it difficult for them to adapt to new technologies and ways of working. Banks may also be resistant to change due to a lack of understanding of the benefits of fintech, which can create challenges when trying to implement new technologies.

The regulatory environment might also make it difficult for the banking sector to implement fintech because the rules may not yet be fully established or they may not be clear on how to deal with new technology. As banks try to comply with rules, this could create uncertainty and hinder the adoption of new technologies.

Although there are many obstacles to embracing fintech, it is important to note that many banks are attempting to overcome them by collaborating with fintech businesses, funding them, or creating their own fintech solutions. This can assist banks in maintaining their competitiveness and utilizing the advantages of fintech.

Conclusion

The future outlook for the fintech-banking industry refers to the predictions and projections of future trends, developments, and changes in the financial technology and banking industry. This includes the forecast of the potential impact of new technologies, changing regulations, and shifts in consumer behavior on the industry.One aspect of the future outlook for the fintech-banking industry is the increasing adoption and integration of technology such as artificial intelligence, blockchain, and digital platforms into banking operations. This is expected to lead to more efficient, secure, and personalized financial services for customers, as well as cost savings for banks.

Another aspect of the future outlook for the fintech-banking industry is the potential for further collaboration and partnership between traditional banks and fintech companies. This can enable traditional banks to leverage the expertise and innovation of fintech companies, while fintech companies can benefit from the established customer base, regulatory compliance, and trust of traditional banks.

The expanding trend of open banking, which permits users to share their financial data with other parties and facilitates the creation of new financial products and services, is also included in the future prognosis for the fintech-banking sector. Customers may expect more competition and options as a result, and banks and fintech firms will have new business prospects.

Though there are challenges in the fintech-banking business, the requirement to follow evolving legislation, particularly in the areas of data protection and security, is one of the key challenges. The problem of ensuring that new technologies are utilized ethically and responsibly is another. This is necessary to prevent undesirable outcomes like financial crime, prejudice, and data breaches.