|

| Image: Moneybestpal.com |

What is Price-Earnings-to-Growth (PEG) Ratio?

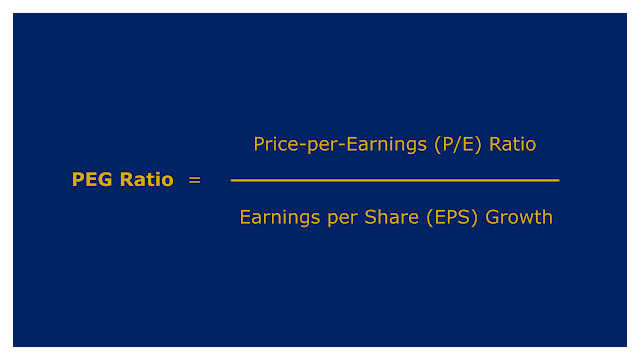

The price-earnings-to-growth (PEG) ratio is a widely used valuation metric in finance and investment, which aims to measure a stock's potential for future growth. It is calculated by dividing the price-to-earnings (P/E) ratio by the company's annual earnings per share (EPS) growth rate.The EPS growth rate, on the other hand, is a metric that measures the rate at which a company's earnings per share have grown over time. It is typically expressed as a percentage and is calculated by comparing the EPS for a specific period (such as a quarter or a year) to the EPS for the same period in the previous year.

When the P/E ratio is divided by the EPS growth rate, the result is the PEG ratio. The PEG ratio can be used to compare the relative value of different stocks, as well as to assess whether a stock is overvalued or undervalued.

Purpose of PEG ratio

The purpose of the price-earnings-to-growth (PEG) ratio is to provide investors and analysts with a measure of a stock's potential for future growth. The PEG ratio is calculated by dividing the price-to-earnings (P/E) ratio by the company's annual earnings per share (EPS) growth rate.The PEG ratio serves as an extension of the P/E ratio, which is a commonly used valuation metric that compares a company's current stock price to its earnings per share. The P/E ratio provides investors with an idea of how much they are paying for each dollar of a company's earnings, but it doesn't account for the company's growth potential.

The main purpose of the PEG ratio is to provide a measure of a stock's relative value, taking into account not only the current valuation but also the expected future growth rate. A PEG ratio of less than 1 is generally considered to indicate that a stock is undervalued, while a PEG ratio of greater than 1 is generally considered to indicate that a stock is overvalued.

The relative worth of various stocks within the same industry or sector can also be compared using the PEG ratio. The first firm would be viewed as being more undervalued and having a better potential for future growth, for instance, if a company in the technology sector has a PEG ratio of 0.5 and another company in the same sector has a PEG ratio of 2.0.

Calculation of the PEG ratio

P/E ratio

The price-to-earnings ratio commonly referred to as the P/E ratio, is a widely used metric in finance and investment that compares a company's current stock price to its earnings per share (EPS). It is calculated by dividing the current market price of a stock by the company's earnings per share.The P/E ratio is a valuation metric that compares the current market price of a stock to the company's earnings per share. It is calculated by dividing the current market price of a stock by the company's earnings per share.

A high P/E ratio may indicate that investors are paying a premium for the stock, while a low P/E ratio may indicate that the stock is undervalued. However, it's important to note that a high P/E ratio doesn't necessarily mean that a stock is overvalued, and a low P/E ratio doesn't necessarily mean that a stock is undervalued.

The P/E ratio can also be used to examine the relative worth of various stocks within the same sector or industry. For instance, the first business would be regarded as being cheaper if it had a P/E ratio of 20 and another company in the same industry had a P/E ratio of 40.

EPS growth rate

The earnings per share (EPS) growth rate is a widely used metric in finance and investment that measures the rate at which a company's earnings per share have grown over time. It is typically expressed as a percentage and is calculated by comparing the EPS for a specific period (such as a quarter or a year) to the EPS for the same period in the previous year.The EPS growth rate is a key metric that reflects a company's ability to generate profits and is often used to evaluate the company's overall financial health and future growth prospects.

For example, if a company's EPS for the current year is $5 and the EPS for the previous year is $4, the EPS growth rate would be 25% (5-4/4*100%). This means that the company's earnings per share have grown by 25% over the past year.

The EPS growth rate is often used by investors and analysts to evaluate the relative value of different stocks. A high EPS growth rate may indicate that a stock is undervalued and has a higher potential for future growth, while a low EPS growth rate may indicate that a stock is overvalued.

Dividing the P/E ratio by the EPS growth rate

Dividing the price-to-earnings (P/E) ratio by the earnings per share (EPS) growth rate is the method used to calculate the price-earnings-to-growth (PEG) ratio, which is a widely used valuation metric in finance and investment. The PEG ratio is used to measure a stock's potential for future growth.Price-Earnings-to-Growth Ratio = PE Ratio / EPS Growth Rate

When the P/E ratio is divided by the EPS growth rate, the result is the PEG ratio. The PEG ratio can be used to compare the relative value of different stocks, as well as to assess whether a stock is overvalued or undervalued.

The PEG ratio is calculated by taking the P/E ratio and dividing it by the EPS growth rate. For example, if a company's P/E ratio is 20 and its EPS growth rate is 10%, the PEG ratio would be 2 (20/10%). This means that the stock is trading at a PEG ratio of 2, which is considered overvalued.

The PEG ratio is used to compare the relative value of different stocks and to assess whether a stock is overvalued or undervalued, taking into account not only the current valuation but also the expected future growth rate. It is also used to compare the relative growth prospects of different stocks within the same industry or sector.

Interpreting the PEG ratio

PEG ratio less than 1: considered undervalued

When a stock's price-earnings to growth (PEG) ratio is less than 1, it is generally considered to be undervalued. The PEG ratio is a widely used valuation metric in finance and investment that aims to measure a stock's potential for future growth.A PEG ratio of less than 1 indicates that the company's earnings are expected to grow at a faster rate than its current valuation suggests. In other words, the stock's price is not keeping up with the company's growth prospects. This may be an indication that the stock is undervalued and has a higher potential for future growth.

For example, if a company's P/E ratio is 20 and its EPS growth rate is 15%, the PEG ratio would be 1.33 (20/15%). This means that the stock is trading at a PEG ratio of 1.33, which is considered undervalued.

PEG ratio equal to 1: considered fairly valued

When a stock's price-earnings to growth (PEG) ratio is equal to 1, it is generally considered to be fairly valued. The PEG ratio is a widely used valuation metric in finance and investment that aims to measure a stock's potential for future growth.A PEG ratio of 1 indicates that the company's current valuation is in line with its expected future growth rate. This suggests that the stock's price is keeping pace with the company's growth prospects and that the stock is trading at a fair value. A PEG ratio of 1 implies that the company's P/E ratio is equal to its EPS growth rate, which might suggest that the stock is neither overvalued nor undervalued.

For example, if a company's P/E ratio is 20 and its EPS growth rate is 20%, the PEG ratio would be 1 (20/20%). This means that the stock is trading at a PEG ratio of 1, which is considered fairly valued.

PEG ratio greater than 1: considered overvalued

When a stock's price-earnings to growth (PEG) ratio is greater than 1, it is generally considered to be overvalued. The PEG ratio is a widely used valuation metric in finance and investment that aims to measure a stock's potential for future growth.A PEG ratio greater than 1 indicates that the company's earnings are expected to grow at a slower rate than its current valuation suggests. In other words, the stock's price is outpacing the company's growth prospects. This may be an indication that the stock is overvalued and has a lower potential for future growth.

For example, if a company's P/E ratio is 20 and its EPS growth rate is 5%, the PEG ratio would be 4 (20/5%). This means that the stock is trading at a PEG ratio of 4, which is considered overvalued.

It's important to remember that a PEG ratio above 1 does not imply that a company is overpriced or will perform poorly in the future. The PEG ratio is a relative indicator that ought to be utilized along with other valuation metrics and a comprehensive examination of the company's finances and future.

When determining the value of a stock, additional aspects like management, market movements, and the company's overall financials should also be taken into account. It is also crucial to take into account the general economic and market conditions that could have an impact on the performance of the stock.

Limitations of the PEG ratio

Assumes constant EPS growth rate

In finance and investing, the price-earnings-to-growth (PEG) ratio is a frequently used valuation indicator that seeks to assess a stock's potential for future growth. However because it relies on a consistent EPS growth rate, it has a drawback. In other words, it makes the unavoidable assumption that the company's earnings per share will increase at the same rate in the future.The EPS growth rate is an important factor in the PEG ratio calculation, and a constant growth rate assumption may lead to inaccurate conclusions about a stock's true value.

Does not account for variations in risk

The price-earnings-to-growth (PEG) ratio has a limitation in that it does not account for variations in risk. This means that it does not take into consideration the level of risk associated with a stock, which is an important factor that can affect its value.Risk is an inherent part of investing and can have a significant impact on the potential return of an investment. A stock that has a high level of risk may also have a higher potential for return, while a stock with a lower level of risk may have a lower potential for return.

For example, a stock in a high-growth industry, such as technology, may have a higher PEG ratio and be considered overvalued, but it may also have a higher potential for future growth and a higher level of risk.

Does not account for variations in dividends

The price-earnings-to-growth (PEG) ratio has the drawback of not taking dividend changes into account. As a result, it disregards the potential income that a stock could produce from dividends, which can have a significant impact on a stock's valuation.Dividends are a form of income generated by a company and paid out to shareholders regularly. The level of dividends paid by a company can be an important factor that affects a stock's value, as it can provide a consistent and stable source of income for investors.

For example, a stock in a high-growth industry, such as technology, may have a higher PEG ratio and be considered overvalued, but it may not offer dividends to shareholders.

The PEG ratio should be used in conjunction with other valuation measures and a comprehensive examination of the company's financials and prospects because it is a relative metric.

The PEG ratio is a commonly used and valuable tool in finance and investing, but it must be used with other metrics and in conjunction with a comprehensive review of the company's finances and prospects because it has limitations.

FAQ

A valuation tool called the PEG ratio contrasts a stock's price-to-earnings (P/E) ratio with its predicted rate of earnings growth. It is computed by taking the annualized EPS growth rate and dividing it by the P/E ratio.

Considering a company's potential for future profits growth, the PEG ratio assists investors in determining if a stock is undervalued or overvalued. In relation to its profits growth, a stock with a lower PEG ratio is thought to be relatively inexpensive, while one with a higher PEG ratio is thought to be relatively costly.

You might think of the PEG ratio as the price an investor is ready to pay for every unit of earnings growth. A PEG ratio of 1, for instance, indicates that an investor is forking over $1 for each 1% increase in earnings. For example, if the PEG ratio is 2, an investor will pay $2 for every 1% increase in earnings.

A PEG ratio of one indicates that the stock is appropriately valued in relation to its profits growth. This is a typical benchmark. A PEG ratio of less than one suggests that the stock is cheap, whilst a PEG ratio of more than one suggests that the company is expensive. These benchmarks, however, are not set in stone and may change based on the market, investor preferences, and the industry.

Some advantages of using the PEG ratio are:

- PEG ratio bases its valuation on a company's past, present, and future performance.

- PEG ratio accounts for variations in the rates of growth among various businesses and sectors.

- Equities with various P/E ratios and growth rates can be compared using PEG ratio.

Some disadvantages of using the PEG ratio are:

- PEG ratio is dependent on projections of future earnings growth, which could be erroneous or unstable.

- PEG ratio does not take into consideration additional elements like debt, cash flow, dividends, competitive edge, etc. that could have an impact on a company's value.

- Businesses with negative or zero earnings or growth rates might not be able to use PEG ratio.